If I have to choose the buzz word for the hospitality technology industry in 2015, it would surely be big data. From BI (business intelligence) to BB (Big Data) the shift is definite, and here to stay. Big Data, which Wikipedia defines as ‘a broad term for data sets so large or complex that traditional data processing applications are inadequate’ has become the central to the business strategy of a smart hotelier in the recent years. With the data volume growing about 50% a year, hotels need big data analytics to define and shape consumer behavior, and maximize their efforts to reach, engage and compel target audiences to action.

Monitor your customer at every touch point

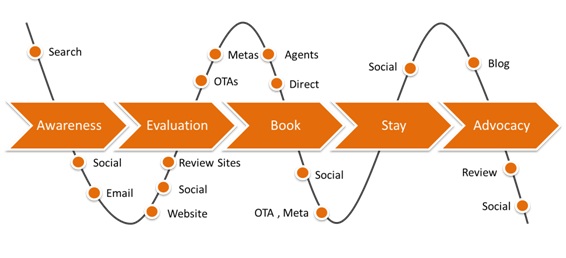

Here’s an interesting fact from Google’s recent study on traveler. Almost half (46%) of travellers who carry out mobile for travel research make their final decision on mobile and then turn to another device to make the booking. With users constantly switching devices during the purchase journey, and getting influenced by social media, mobile and other web-based exchanges, hospitality industry is being forced to constantly adjust and refine their marketing strategies.

Faced with a multi-faceted and multi-platform traveler whose preference would change depending on the type of trip, hotels need to get close to them by capturing prompt, accurate information – and correctly interpreting it – to change the course and outcome of interactions.

Integrate Big Data Analytics into your Revenue Management System

Revenue management is all about selling the right product to the right person at the right channel. Dynamic pricing helps hotels to optimize demand with flexible pricing, however, with the online distribution landscape continuously throwing new challenges, the complexities of managing hotel’s revenue has increased many-fold. With each channel having its rule, segment, buying behavior and platform, managing rate and availability in real-time to these channels can become a nightmare. Gone are the days when hotels would depend on historical data for rate forecasting – today’s revenue managers need to consider consumer’s buying behavior, search pattern, social networking habit for right pricing. This is where big data analytics come into help revenue managers include individual consumer behaviors, including loyalty and lifetime value, past purchases of ancillary services, and online shopping activity in their pricing model.

Personalized marketing for maximum benefit

Each customer is different. So treat them differently. According to an Adobe research, about 70% of today’s online buyers expect personalized service from brands. For hospitality industry, expectation is even higher. OTAs, with their scale of marketing budget and technology superiority, has been one of the earlier adopters of Dynamic Content Personalization’ which allows websites the ability to recognize a past visitor, tag them and create personalized, unique and optimized experiences for consumers – finely tuned for each individual preference. For hotels, personalization also gives them an opportunity to serve the guest better, earn loyalty, while gathering 360 degree view of the guest throughout the guest journey to provide more relevant offers, improve communications and increase engagements. Big Data involves the collection, management and analysis of multiple sources of data, both structured and unstructured, while analytics give the insight to optimize the information.

Swapan Kumar Manna is the Sr. Executive – Marketing at eRevMax. He can be reached at swapanm@erevmax.com.

Swapan Kumar Manna is the Sr. Executive – Marketing at eRevMax. He can be reached at swapanm@erevmax.com.