Host Hotel Systems integrates with eRevMax for seamless online booking connectivity

Marketing Manager Joao Rodrigues of Host Hotel Systems anticipates that this integration will improve overall customer satisfaction and will give them the ability to expand their distribution portfolio to reach out to vast audience. He also thanks to eRevMax for this integration which removes the need for manual input.

Marketing Manager Joao Rodrigues of Host Hotel Systems anticipates that this integration will improve overall customer satisfaction and will give them the ability to expand their distribution portfolio to reach out to vast audience. He also thanks to eRevMax for this integration which removes the need for manual input.OTA Consolidation – preparing ourselves for better sales procedures

Channel management is fundamental to hoteliers

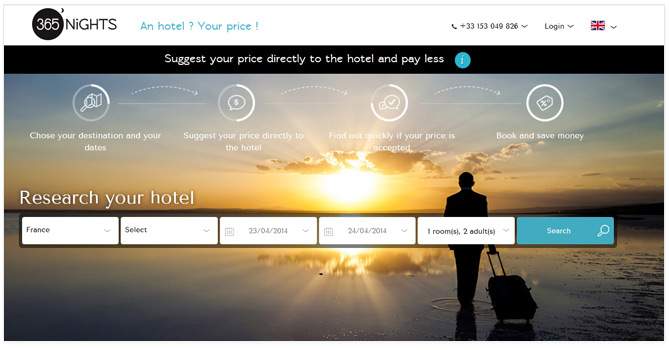

Barteo – 365nights.com completes XML integration with eRevMax

Improve direct booking through incentives

eRevMax Channel Ecosystem connects with leading Japanese OTA for deeper integration

Why It’s Time to Include Meta Search in Your Distribution Portfolio

The Indian Traveller 2014

The third largest economy in the world India is becoming on the major player in travel space. Despite a slower economy and foreign exchange volatility, over 15 million Indian travellers are planning foreign trip shows an infographic, recently released by eRevMax. The Middle East and Far East have certainly been leaders so far but interestingly, India is catching up. The infographic reports that 33 percent of travel-related searches within India are now made online, with mobile being the preferred choice. The solutions provider suggests regional online travel agents should focus on connecting the hotesl of Middle East and APAC region to gain more revenue.

To access the full infographic, click Infographic: The Indian Traveller 2014

Newshound: Trends and Reports – Hotel Online Distribution

GHOTEL hotel & living selects RateTiger for smart online room distribution

German hospitality group GHOTEL hotel & living has selected RateTiger’s industry leading Channel Manager to maximise its distribution reach for its unique accommodation offerings by updating distribution channels efficiently in real-time.

http://www.eglobaltravelmedia.com.au/z-more/technology-more/ghotel-hotel-living-selects-ratetiger-for-smart-online-room-distribution.html

The Future of Hotel Marketing: Social Media Synopsis

Hotel chains that are open to 24/7 online social communications with their fan base can sense the power of a free flowing exchange of ideas, and capitalize on a low-cost marketing channel solution. Communication with customer base via social media channels is now expected as standard, whether these platforms are utilized to shape brand image, facilitate user-generated content or compliment a targeted pay-per-click campaign, social media is vital to the success of a hotel property.

http://hotelexecutive.com/business_review/3441/the-future-of-hotel-marketing-social-media-synopsis

Data transformation key for revenue managers

As more data becomes available, revenue managers must be able to filter and make sense of only the best information in order to achieve their goals, sources said during a Hospitality Sales and Marketing Association International (HSMAI) webinar. “Some people may say that we’re drowning in data, but I think it’s more accurate to say that we’re drowning in information,” said Kevin Coleman, partner and COO at Intelligent Hospitality, a hotel business intelligence company that provides reporting and analytics for hotel sales, marketing and revenue management.

http://www.hotelnewsnow.com/Articles.aspx/10263/Data-transformation-key-for-revenue-managers

A Call to Arms: How to Shift Market Share from the OTAs to the Hotel Website

This year, the hospitality industry is in for a lot of pain. OTA dependency continues to plague the hospitality industry, despite gains in the past three years and positive trends in all three industry indicators. This isn’t new. What’s new is the pain to the bottom line inflicted by the fat commission checks hoteliers are now paying Expedia and other OTAs, due to the widespread adoption of Expedia”s and Booking.com”s agency model in the U.S.

http://www.hospitalitynet.org/column/global/154000392/4060290.html