Let’s demystify the big news from Google who has changed its business model for hotel bookings yet again! Google Hotel Finder has been silently sun-setted; Google is now pushing what it calls the Hotel Ads Commission Program. This is an attempt to enter the OTA space however shying away from being an intermediary; rather Google aims to be a facilitator of commission based bookings.

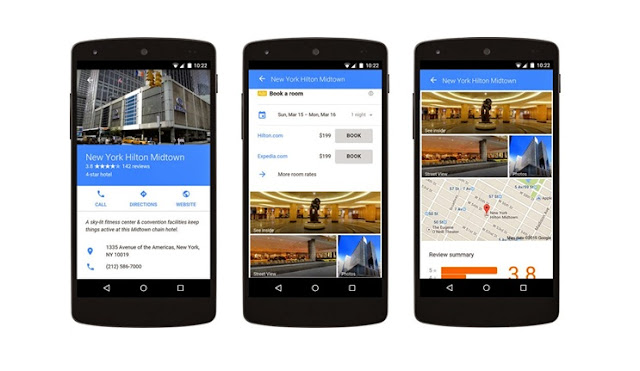

Contrary to the OTA models where the channel “owns” the guest relation, through Google Hotel Ads, hotels will be in full control starting from a guest’s search process to the completed booking. And most importantly, hotels only pay to Google for successful bookings.

Here are 3 things that you should know to make this new platform work for you –

More revenue for small and independent hotels

Everyday millions of people search for various destinations and hotels on Google – that means millions of potential guests for your hotel. In 2013, Google launched its cost-per-click model of Google Hotel Ads which small and independent hotels used to get more direct traffic to their brand.com website. But with this new commission-based model which is similar to TripAdvisor’s Instant Booking feature; Google aims to take out the complexity of the bidding process and charge hotels direct commissions only for completed bookings. This will help hotels confidently use Google as a distribution platform. With over 340 million monthly unique visitors, TripAdvisor’s Instant Booking feature has become a big hit and Google needed to widen its offering to stay in the game – which it has done now with this new development. It’s time for small independent hotels to take the first mover’s advantage and leverage Google’s huge audience base.

Converting guests within the same booking window

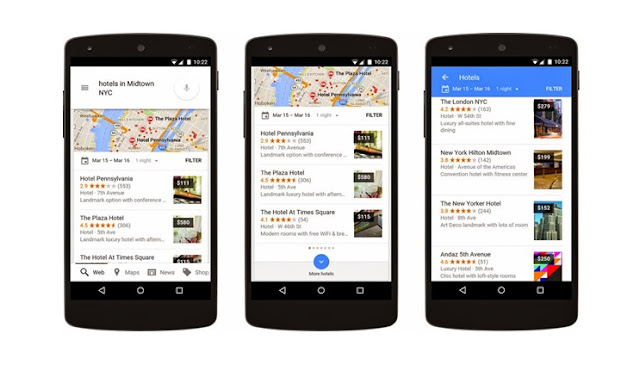

Today online consumers want quick information and simpler booking processes – which means they prefer to get information in one place instead of having to look around on different websites. In the Cost per click (CPC) model, guests are re-directed to the hotel website – which takes some time and ultimately frustrates the guest who might not complete the booking process. With the new book on Google, the search engine major facilitates the complete booking process within the same window without the guest having to visit the hotel website. The process is seamless between the hotel, Google and the guest. As soon as a booking is made, the hotel sends a booking confirmation email directly to the guest thereby owning the guest relationship from step one. The hotel also answers post-booking queries and handles changes to the reservation or cancellations.

Booking through multiple devices

Though mobile booking is growing exponentially among online travellers, desktop still holds number one position when it comes to hotel bookings. Perhaps this is the driving force behind Google’s move to launch this feature on desktop and tablet as well besides mobile devices- making it easier for more hotels to participate. Another interesting fact is travellers can avail information about hotel amenities within their search results. This added feature is an upsell opportunity for hoteliers to keep their potential guests updated on all the amenities that the hotel provides including Wi-Fi, free breakfast, parking availability, swimming pool, business centre etc.

With the exit of the Hotel Finder programme, Google is trying to reposition themselves as a ‘big brother’ in the travel industry – and is already becoming a threat to the online travel agents.

Image Credit: Google Blog